Financial Aid Student Guide

This student guide is designed to help you understand what financial aid may be available to you and what you can do so that you may receive that financial aid. If this information does not answer your questions, our staff is available to assist you. Please call us at (619) 660-4201 or visit the Financial Aid Office in the One-Stop Student Services Center (Building A300) near the corner of Fury Lane and Rancho San Diego Parkway.

The Financial Aid Process |

Page 2 |

When to Apply for Aid – Important Dates |

Page 3 |

General Requirements |

Page 4 |

Enrollment Requirements |

Page 5 |

How to Apply for Financial Aid |

Page 6 |

Costs & Awarding |

Page 7 |

Financial Aid Programs |

Page 9 |

Satisfactory Academic Progress |

Page 13 |

Withdrawals & Repayment of Financial Aid funds |

Page 14 |

Your Rights & Responsibilities |

Page 15 |

Miscellaneous |

Page 16 |

Important Websites & Phone Numbers |

Page 17 |

1

- Click on each topic to open it individually

STEP 1:

Create an FSA ID at Federal Student Aid for yourself and one parent, if required, and complete the Free Application for online at Federal Student Aid (FAFSA). Be sure to enter Cuyamaca College’s federal school code on your FAFSA, when asked, in order for us to receive your FAFSA information. Our federal school code is 014435.

![]()

STEP 2:

Your Student Aid Report (SAR) will be emailed or mailed to you by the office of Federal Student Aid approximately 2-3 days after your FAFSA is processed. This SAR shows you all of the information you entered on your FAFSA. Verify that the information is correct and Make Corrections, if necessary, by logging back in to your FAFSA at Federal Student Aid (FAFSA).

![]()

STEP 3:

It may take up to 10 business days for the Cuyamaca Financial Aid Office to receive your FAFSA information.

If the information is correct on your SAR, the Financial Aid Office will send you a Document Request Letter via email or mail with a list of required documents to complete (ex. Independent/Dependent Student Verification Worksheet, IRS Tax Transcript, etc.)

You can also check your application status and print your required documents by logging onto WebAdvisor and clicking on the “Cuyamaca Financial Aid” link, then “ Application Status and Awards.” To access WebAdvisor go to “Cuyamaca Financial Aid” and click “Check Your Status.”

STEP 4:

Complete and submit all of the required documents, as soon as possible, to the Financial Aid Office in order to complete your financial aid file.

You are also responsible for any other possible documents that may be required upon further review of the SAR.

Note:

Once your file is complete, please allow for processing time before receiving further notifications about your financial aid award.

STEP 5:

A Financial Aid Advisor will evaluate your completed file to determine your financial aid eligibility.

If eligible for financial aid, you will be emailed or mailed a Financial Aid Award Letter showing the type(s) and amount(s) of financial aid you are eligible to receive.

You may also view this Award Letter on WebAdvisor via the “Cuyamaca Financial Aid” link, and then click “Application Status and Awards.”

2

(BACK TO TABLE OF CONTENTS)

August 22, 2016 (First day of the fall semester) |

| First day to apply for an Emergency Book Loan. |

September 2, 2016 |

| Cal Grant deadline for Community College students for the 2016-2017 Competitive Cal Grant. |

September 6, 2016 |

| fall Census Date |

October 1 2016

|

| Applying for financial aid for the 2017-2018 year. Apply online at Federal Student Aid |

December 2, 2016 |

| Deadline to submit student loan application for fall only students |

January 30, 2017 (First day of the spring semester)

|

| First day to apply for an Emergency Book Loan |

February 13, 2017 |

| Spring Census Date |

March 2, 2017 |

| Deadline date for new Cal Grant applicants to mail the GPA verification form for 2017-2018 to the California Student Aid Commission (CSAC). FAFSA application must also be completed by this date in order to be considered for the Cal grant. |

May 26, 2017 |

| Deadline to submit student loan application for spring or full year students |

June 30, 2017 |

| Last Day to submit a valid 2016-2017 FAFSA, or Student Aid Report (SAR) |

July 10, 2017 |

| (or last day of enrollment, whichever comes first) Deadline to complete your 2016-2017 financial aid file |

3

(BACK TO TABLE OF CONTENTS)

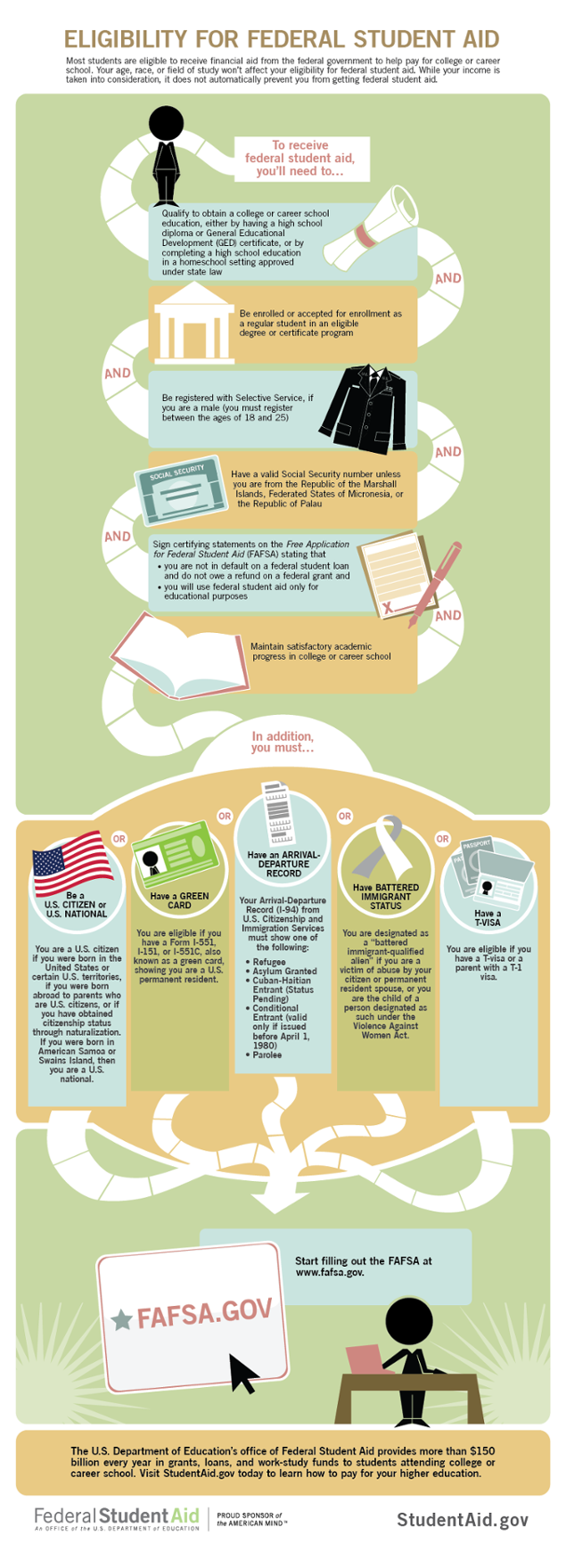

IF THE ELIGIBILITY INFORMATION IS UNCLEAR PLEASE WATCH THE VIDEO BELOW

Eligibility for Non-citizens

The Department of Education (DOE) will compare the information listed on your FAFSA with the U.S. Department of Homeland Security (DHS) to verify your citizenship status. If your citizenship status is not verified by DOE’s first match, your record will automatically be selected for a second verification by the DOE. If the second verification is not successful, you must submit verification of your citizenship to the Cuyamaca College Financial Aid Office no later than your last day of attendance or July 5, 2017, whichever is first. The Cuyamaca Financial Aid Office will submit your citizenship documents to the DHS within 10 business days and request verification of your citizenship status based on your current documentation.

AB1899

Requires students who are victims of trafficking, domestic violence, and other serious crimes who have been granted a specified status under federal law, to be exempt from paying nonresident tuition at the California State University and the California Community Colleges, and to be eligible to apply for, and participate in, all student financial aid programs and scholarships administered by a public postsecondary educational institution or the State of California.

AB540 Students

Assembly Bill 540 (AB 540) is a California state law that allows students who meet certain requirements to pay in-state tuition fees at any UC, CSU, or California Community College.

Aid to Eligible Undocumented Students

Undocumented students who have attended and graduated from a California high school or have attained a G.E.D are considered AB540 students who may qualify for assistance such as the community college fee waiver and Cal Grant.

California Dream Act (CADA)

The California DREAM Act is a state legislation that will allow undocumented, AB540 students to apply for and receive institutional financial aid in the public colleges and universities in California such as institutional grants, community college fee waivers and Cal Grant. California Dream Act

Aid to Foreign Students

Cuyamaca College is not able to assist foreign students with federal or state aid. To be eligible for federal or state aid, you must be a citizen of the U.S. or an eligible noncitizen.

H.S. Diploma/GED required for New Students

Students enrolling for the first time after July 1, 2012 must have a High School Diploma, GED, or a recognized state equivalent to be eligible for any federal financial aid. A student who does not possess a high school diploma, GED, or a recognized state equivalent can obtain a GED. Information on obtaining a GED can be found at the Grossmont Adult School website High School Dipplmona/High School Equivalency.

Drug Convictions

You cannot receive federal financial aid for a specified period if you have been convicted of an offense for the sale or possession of an illegal drug while receiving financial aid.

– Convictions for possession:- One conviction – ineligible for federal financial aid for one year from the date of conviction.

- Two convictions – ineligible for federal financial aid for two years from the date of the second conviction.

- Three or more convictions – ineligible for federal financial aid for an indefinite period of time.

- One conviction – ineligible for federal financial aid for two years from the date of conviction.

- Two or more convictions – ineligible for federal financial aid for an indefinite period of time.

You may regain eligibility for federal financial aid the day after the period of ineligibility ends or you successfully complete a qualified drug rehabilitation program. If you are convicted of a drug offense during a time that you are receiving federal financial aid you must notify the financial aid office immediately.

4

(BACK TO TABLE OF CONTENTS)

General Enrollment Requirements

Enrollment status is the number of units that your financial aid award is based. This status is set when your first award is made. Your enrollment status is checked on census date, 9/05/17 for the fall semester and 2/12/2018 for the spring semester. If you are awarded after 9/05/17 then your census date will be the date you are awarded financial aid. Your award is adjusted based on the number of units you are enrolled in on census date. dding classes after the enrollment status has been set, including classes you are on a waitlist for, will not increase your award. Dropping classes may cause your award to decrease or be canceled.

| Status | Fall or Spring | ||

| Full Time | 12+ Units | ||

| 3/4 Time | 9 - 11.5 Units | ||

| 1/2 Time | 6 - 8.5 units | ||

| Less than 1/2 Time | 0.5 -5,5 units | ||

| Census Dates | |

| Fall 2017 | September 5, 2017 |

| Spring 2018 | February 12, 2018 |

Summer financial aid enrollment status is the same as for fall or spring. Please see the Financial Aid Office for additional information about summer.

Enrolling at Cuyamaca and Grossmont (Consortium Agreement)

Units taken concurrently at Cuyamaca College and Grossmont College may be added together for financial aid purposes if a student has a declared a major and educational objective offered at Cuyamaca College. A student must apply for financial aid, complete a consortium agreement for each semester, and be enrolled in a minimum of 6 overall units combined at Cuyamaca College and Grossmont College. Students are allowed to submit only ONE consortium agreement per semester, must maintain enrollment in at least 1 course at Cuyamaca College, and combined courses must be required for the students declared major and educational objective.

This agreement covers one semester only, and should be turned in after census date and no later than November 10, 2017 for fall 2017, and April 27, 2018 for spring 2018. Census date is 08/05/2017 for fall 2016 and 02/12/2018 for spring 2018. If you are awarded after 09/06/16, your fall census date is your award date. If you are awarded after 02/12/18, your spring census date is your award date. You must be enrolled in the courses listed on the consortium agreement by your census date, and have a declared major of record with Admissions and Records that matches the major/educational goal on the consortium agreement, or the agreement will be canceled. If you drop below six units total, the Consortium Agreement will be canceled, and your financial aid award may go down or be canceled.

Students Enrolled in Distance Education (on-line) Courses

Students who are enrolled in distance education (on-line) courses only must reside in California during that semester to be eligible for financial aid. Students must verify their place of residence with the Financial Aid Office. If you are enrolled in on-line courses only and live outside of California, you are not eligible for federal financial aid. For more details, please visit our website for enrollment in on-line courses, or contact the Financial Aid Office.

Changing Schools

If you will be changing schools, keep in mind that your financial aid does not automatically go with you. To receive financial aid at your new school, contact your new school’s Financial Aid Office to find out what you must do to receive financial aid at that school.

Cuyamaca College Financial Aid New School

(Contact your new school about Financial Aid)

5

(BACK TO TABLE OF CONTENTS)

If you wish to apply for financial aid, you must complete the following steps. You must reapply for financial aid each year. Awards are not automatically renewable. (Refer to page 2 for a review of the financial aid process)

For the 2017/2018 Year:

STEP 1: Apply for admission to Cuyamaca College.

STEP 2: Complete and file a Free Application for Federal Student Aid (FAFSA). This form is used to apply for most financial aid programs. The FAFSA provides information needed to calculate your and/or your parents’ ability to help pay your college costs.

- Cuyamaca College’s federal school code is 014435.

- Be sure to list all colleges you plan to attend.

- Do not date or submit your FAFSA before 1/1/2016.

- Accuracy is very important so read the instructions carefully.

NEED HELP UNDERSTNDING HOW TO COMPLETE THE FAFSA WATCH THIS VIDEO

You can apply for financial aid using FAFSA on the Web at Federal Student Aid or you may select this link to the Cuyamaca College Financial Aid website

STEP 3: Complete and submit all required documentation to the Financial Aid Office. To determine if you need to submit required documentation log on to WebAdvisor and select “Cuyamaca Financial Aid,” then “Application Status and Awards.” Under “Document and Tracking Information” any required documents will say “Not Rec‘d.” Incomplete or conflicting information may delay your financial aid process. Make sure your address, e-mail, and phone number are current in WebAdvisor so that we can contact you.

STEP 4: If you have attended other colleges, it is your responsibility to have official academic transcripts mailed to the Admissions and Records Office to be properly evaluated for graduation/transfer purposes.

STEP 5 (if applicable): For Cal Grant applicants, complete the FAFSA online and submit the GPA verification form by March 2, 2016. Cuyamaca College will automatically send GPA information for you if you have completed 16 or more college-level units. If you have not completed 16 or more college-level units then you will need to send a GPA verification form to the California Student Aid Commission. The GPA Verification form is available from the Financial Aid Office, from your local high school counselor, or online here at California Student Aid Commission. Community College Students have until September 2, 2016 to apply for a Cal Grant B Competitive award.

All information submitted to apply for financial aid is confidential. The Family Educational Rights and Privacy Act of 1974 prohibit the Financial Aid Office from disclosing any information without written authorization.

When all required documents have been received by the Financial Aid Office, your financial aid file is considered complete and your application will be reviewed on a “first-completed, first-considered” basis. A Financial Aid Advisor may request further information to determine your financial aid eligibility. Your financial aid award will be calculated based on your financial need and the federal and state funds available.

If you are eligible for financial aid, you will receive a Financial Aid Award and Acceptance Letter that is an offer of aid. If you are not eligible, you will receive a letter stating why you are not eligible. Your Financial Aid Award and Acceptance Letter will outline the terms and conditions of the financial aid award and it will provide actual and/or projected disbursement dates as to when funds will be sent to you. If you did not pass the appropriate number of units, or your GPA is below a 2.0 for the fall 2016 and/or spring 2017 semesters you may not be eligible for a retroactive award or a summer award.

The deadline to submit a valid Free Application for Federal Student Aid (FAFSA) or FAFSA correction for 2016-2017 to the federal processor is June 30, 2017. The deadline to complete your financial aid file at Cuyamaca College is July 10, 2017, or 5 business days after your last day of enrollment, whichever comes first.

Disbursement Options through Money Networks

Starting with the 2016-2017 academic year all Grossmont and Cuyamaca College students now have two ways of getting financial aid disbursements and college refunds faster than a check. Select how you would like to receive your funds:

- Direct deposit to a checking or savings account. Funds generally post to your account 1-5 business days.

- The GCCCD Cash Card, which you can use like a debit card or ATM card. Funds are delivered the same day.

Register NOW for an electronic option so you can receive any funds you are eligible for faster and safer! If you do not choose an electronic option, any aid or refunds you are eligible for will be disbursed to you via paper check. Checks will be mailed and may take 7-10 days for you to receive. Why wait? Sign up for an electronic option now!

Find out more information and how to register at our website at http://www.gcccd.edu/cashcard

6

(BACK TO TABLE OF CONTENTS)

Family Contribution

It is expected that you or your parents have  the first responsibility for paying for your college education. The information you report on your Free Application for Federal Student Aid (FAFSA) is used in calculating the amount of money the government believes you or your parents can contribute to pay for your college education. This amount is called your expected family contribution (EFC) and it is based on various factors such as income, assets, family size, and benefits (for example, unemployment, or Social Security). All available resources, whatever the origin, must be reported as soon as they become known. Failure to report resources may result in having to repay the Grossmont-Cuyamaca Community College District some or all funds that you have already received. The following table shows examples of estimated average family contributions for a dependent student.

the first responsibility for paying for your college education. The information you report on your Free Application for Federal Student Aid (FAFSA) is used in calculating the amount of money the government believes you or your parents can contribute to pay for your college education. This amount is called your expected family contribution (EFC) and it is based on various factors such as income, assets, family size, and benefits (for example, unemployment, or Social Security). All available resources, whatever the origin, must be reported as soon as they become known. Failure to report resources may result in having to repay the Grossmont-Cuyamaca Community College District some or all funds that you have already received. The following table shows examples of estimated average family contributions for a dependent student.

| Conditions | Case 1 |

Case 2 |

Case 3 |

Case 3 |

| Income | $26,700 | $41,00 | 64,500 | 80,000 |

| Net Assets* | $44,200 | $44,200 | $44,200 | $44,200 |

| Family Size | 4 | 4 | 4 | 4 |

| Age of Older Parent | 45 | 45 | 45 | 45 |

| Number in College |

1 | 1 | 1 | 1 |

| Expected Family Contribution (EFC) |

$0 | $2000 | $7000 | $12,700 |

*Assets do Not include home value or family business value.

NOTE: We must count the family contribution as a resource, if you are considered dependent, even though you may not be receiving any assistance from your parent(s).

7

– Dependent or Independent

Whether you are considered a dependent or independent student will determine whose financial information you will need to report on the FAFSA. By federal regulation you are considered an “independent” student for the 2018-2019 academic year if at least one (1) of the following situations describes you:

- You were born before January 1, 1993.

- Both of your parents are deceased, or you are or were (until age 18) in foster care or a ward/dependent of the court.

- You are a veteran of the U.S. Armed Forces.

- You have children who receive more than half of their support from you.

- You have dependents (other than your children or spouse) who live with you and who receive more than half of their support from July 1, 2016 through June 30, 2017.

- You are married or separated but not divorced as of the date you complete the FAFSA.

- You will be working on a master’s or doctorate program during the school year 2016-2017.

- You are currently serving on active military duty for purposes other than training.

- You are an emancipated minor or in legal guardianship as determined by a court in your state of legal residence.

- You were an unaccompanied youth who was homeless on or after July 1, 2015 (status determined by high school district or director of an emergency shelter program, runaway or homeless youth basic center or transitional living program).

If you do not meet one (1) of the above requirements, you will be considered a “dependent” student for financial aid purposes. You will be required to provide parent information whether or not you live with your parents or receive financial assistance from them.

IF YOU REMAIN UNCLEAR ABOUT YOUR DEPENDENCY STATUS INFORMATION CLICK ON THE VIDEO BELOW.

?

Financial Need

Your financial need is determined by subtracting your expected family contribution (EFC) from your standard student budget or cost of attendance (COA).

FINANCIAL NEED FORMULA

Your standard student budget (how much it cost to attend) - Your expected family contribution (EFC) |

| = Your financial need |

IF YOU ARE UNCLEAR ABOUT "FINANCIAL NEED" CLICK ON THE VIDEO BELOW.

The Financial Aid Office uses standard student budgets that are an estimate of how much it will cost a student to attend college. Your actual costs may differ from our standard budgets.

| Housing Status | Live With Parent(s) | Live With Relatives/Friends | Live away from Parents |

| Fees | 1336 | 1336 | 1336 |

| Books and Supplies | 1700 | 1700 | 1700 |

| Food & Housing | 4600 | 8200 | 11300 |

| Personal Expenses | 2500 | 2800 | 2800 |

| Transportation | 1200 | 1200 | 1200 |

| TOTAL | $11336 | $15236 | $18336 |

– Additions to Budgets

- Out of State Tuition cost per unit: ($200 subject to change).

- Dependent Care Costs (must be documented).

8

(BACK TO TABLE OF CONTENTS)

There are generally three types of financial aid: GRANTS — money that does not have to be repaid (unless you drop from school or owe a refund), including scholarships; EMPLOYMENT — money you can earn through part-time work while attending school and LOANS — money you borrow that you must pay back in the future. Since many students are eligible for more than one type of financial aid, we offer a “package” of aid.

GRANTS

– Federal Pell Grant

The Federal Pell Grant is available for you as an undergraduate until you receive your first bachelor’s degree or have received 12 full-time semesters of Pell Grant aid. Federal Pell Grants range from $598 to $5815 per academic year depending upon your Expected Family Contribution (EFC), your cost of attendance (COA), and your enrollment status. Effective July 1, 2012, the maximum lifetime eligibility to receive a Pell Grant is 12 full-time equivalent semesters (approximately 6 years). This limit includes all prior semesters of Pell Grant aid received at all prior schools. After receiving 12 full-time equivalent semesters of Pell grant, eligibility for Pell grant ends. For more information, go to Federal Student Aid Website.

– Federal Supplemental Educational Opportunity Grant (FSEOG)

FSEOG is a federal grant program for undergraduate students who have “exceptional financial need,” and have not received a bachelor’s degree. First priority will be given to students enrolled full-time who receive a Federal Pell Grant and show exceptional financial need on a first-come, first-served basis. At Cuyamaca College, grant amounts may range from $100 to $400 per academic year. For more information, go to Federal Student Aid Website.

– Cal Grants

Cal Grants are state grants managed by the California Student Aid Commission (CSAC) and are for California residents or eligible non-residents who show financial need, meet the program and academic requirements, and apply on time. There are two types of Cal Grants: entitlement and competitive.

-

Cal Grant Entitlement is an award that is guaranteed for every high school senior or recent high school graduate that meets the program and academic requirements (at least a 3.0 GPA for Cal Grant A; at least a 2.0 GPA for Cal Grant B), meets the family income and asset ceilings, and applies on time.

-

Cal Grant Competitive is for those that are not high school seniors or recent high school graduates. These awards are not guaranteed and only a limited number are available each year – half are set aside for those that apply by the March 2nd deadline and the other half for California Community College students who meet the September 2nd deadline.

To apply for a Cal Grant, submit a FAFSA and GPA Verification form postmarked by March 2nd or by September 2nd each year. For the September 2nd deadline, grade point averages are automatically verified for Cuyamaca College Students who have completed 16 or more college-level, units, by the Cuyamaca College Admissions and Records Office. For more Cal Grant information visit the California Student Aid Commission Website.

– Cal Grant A

Cal Grant A is an entitlement or a competitive grant. It is targeted toward students with high GPAs and moderate income. This grant pays for tuition at tuition-charging institutions. You cannot receive a Cal Grant A while enrolled at a community college. Community college students can have their grants put on “community college reserve” for up to three years. Once you transfer to a tuition-charging institution your grant can be used. The maximum award is $9,084 for students attending independent colleges and universities, up to $12,192 for University of California students, and up to $5,472 for California State University students.

– Cal Grant B

Cal Grant B is an entitlement or a competitive grant. It provides a living allowance for low-income students and tuition payment for students’ second through fourth year of study at tuition-charging institutions. For 2016-2017, the maximum living allowance has been set at $1,670.

NEED MORE HELP, WATCH THE FOLLOWING CAL GRANT VIDEO.

9

A new grant program specifically aimed at Cal Grant B recipients who are attending full time. Approximate yearly amount is $600. This program is funded by the State of California and administered by the State Chancellor’s Office.

– Cal Grant C

Cal Grant C is a competitive grant for vocational students who are enrolled in programs from nine months to two years in length. Cal Grant C provides $547 a year for books, tools & equipment. Cal Grant C pays up to $2,462 for tuition at tuition-charging institutions.

– Extended Opportunity Program and Services (EOPS)

EOPS is a state funded program designed primarily for the recruitment and retention of California residents who are considered educationally disadvantaged (as determined by EOPS), have not completed more than 70 units of degree applicable coursework, are enrolled full-time (12 units or more), and qualify for the Board of Governors Fee Waiver, method A or B. For more information, go to the EOPS Webpage.

– Cooperative Agencies Resources for Education (CARE)

CARE is a state funded program designed to recruit and assist single parent recipients of Temporary Assistance for Needy Families, (TANF), or Cal Works who would like to attend college and are EOPS eligible. CARE provides support services and/or grant funds to enable academic success and to assist students in attaining their career and vocational goals. For more information, go to the CARE Webpage.

– Chafee Grant

The California Chafee Grant Program is available for current or former foster youth to use for career and technical training or college courses. The maximum grant amount is $5000 per year. Students must be enrolled in six or more units each semester to be eligible for the Chafee Grant. For questions regarding eligibility please contact Pam Fleming in the Financial Aid Office at 619-660-4291.

– Child Development Grant

The Child Development Grant program is administered by the California Student Aid Commission (CSAC). The program is designed for students who are attending a California Community College or four-year institution and pursuing a Child Development permit to teach or supervise in licensed children’s centers. At community colleges, you can receive up to $1000 each academic year and you must sign a service commitment agreement to provide one full year of service in a licensed children’s center for every year you receive the grant. For more information, go to www.csac.ca.gov and search “Child Development Grant.”

– Bureau of Indian Affairs Higher Education Grants (BIA)

Individual tribes may provide money to help enrolled members pay for college. The amounts of the grants vary according to the individual tribe. To apply, contact your tribe. You may also contact The Bureau of Indian Affairs Tribal Operations in Sacramento, at (916) 978-6000 or Riverside, at (951) 276-6624, or the San Diego Indian Human Resource Center, Inc. at (619) 281-5964 to obtain tribe contact information. Complete appropriate items and send it to the Financial Aid Office. A FAFSA must also be completed. Watch for deadlines—each tribal agency establishes its own deadline.

– Board of Governors Fee Waiver (BOG)

This program waives the enrollment fee, and for some students the student center construction fee and health fee. The BOG is for residents of California and Eligible Non-residents who have financial need. Students will be considered for this fee waiver as part of the financial aid application process or you may apply separately online.

You may apply by completing a Free Application for Federal Student Aid (FAFSA) at Federal Student Aid (FAFSA) Website OR by completing the online fee waiver application at Cuyamaca Financial Aid Website and select “Apply for Financial Aid,” then “BOGW.” The Board of Governors Fee Waiver will not be applied retroactively towards a prior semester’s mandatory fees. The Board of Governors Fee Waiver and all supporting documentation, and a calculated EFC must be reviewed and approved by the last day of the semester or your last day of your enrollment, whichever comes first.

NEED MORE HELP, WATCH THE FOLLOWING BOG WAIVER VIDEO.

10

SCHOLARSHIPS

important to research and apply for any available scholarship. For additional scholarship search information contact the Cuyamaca College scholarship specialist Ernie Williams at (619) 660-4537, or visit the Cuyamaca Scholarship Web Page Cuyamaca Scholarship Webpage.

important to research and apply for any available scholarship. For additional scholarship search information contact the Cuyamaca College scholarship specialist Ernie Williams at (619) 660-4537, or visit the Cuyamaca Scholarship Web Page Cuyamaca Scholarship Webpage.EMPLOYMENT

The Work-Study programs give students the opportunity to earn part or all of their financial need by working on campus or off campus in community service positions while they are in school. Examples of the jobs available are: teacher’s aide, clerk, grounds person, custodian, and lab assistant. Your wage will be determined by the type and difficulty of the work that you choose.

– Student Employment

The Career Center helps students find part-time employment in the community. All students enrolled at Cuyamaca College are eligible for Student Placement Center services. For more information visit their website at Career Center Services.

LOANS

Cuyamaca College participates in the William D. Ford Federal Direct Loan Program by offering subsidized and unsubsidized Direct Student Loans (Direct Loans). Federal Direct Student Loans, subsidized or unsubsidized, are low-interest rate loans made to students by the federal government.

- Direct Subsidized Loan: These loans are available

to students who demonstrate financial need. The federal government pays the interest on this loan while you are in college and during deferment periods.

to students who demonstrate financial need. The federal government pays the interest on this loan while you are in college and during deferment periods. - Direct Unsubsidized Loan: These loans are available to all eligible students and are not based on financial need. You are responsible for all interest payments (or capitalization of interest) from the date the loan is disbursed.

– The interest rate: As of July 1, 2016 the interest rate for a subsidized loan is fixed @ 3.76% for subsidized loans disbursed from July 1, 2016 to June 30, 2017. The interest rate for unsubsidized loans is fixed at 3.76%.

– The loan amounts: Freshmen students may borrow a base amount of $3,500 (subsidized and/or unsubsidized); sophomore students may borrow a base amount of $4,500 (subsidized and/or unsubsidized) per academic year. Loan amounts for one semester only are one-half (1/2) the maximum yearly loan amount, not to exceed need or cost of attendance.

11

(BACK TO TABLE OF CONTENTS)

Satisfactory Academic Progress

For Cuyamaca College, SAP standards are evaluated by measuring the maximum time frame and pace of progression a student takes to complete their degree objective (Quantitative Standard) and a student’s GPA (Qualitative Standard). These standards are evaluated at the time of application for federal financial aid funds for new applicants and at the end of each enrollment period (fall, spring and/or summer) for continuing applicants. SAP standards apply to all students regardless of previous financial aid history.

the maximum time frame and pace of progression a student takes to complete their degree objective (Quantitative Standard) and a student’s GPA (Qualitative Standard). These standards are evaluated at the time of application for federal financial aid funds for new applicants and at the end of each enrollment period (fall, spring and/or summer) for continuing applicants. SAP standards apply to all students regardless of previous financial aid history.

Financial aid eligibility requires students to declare a major in an eligible program, whether that is for an Associate Degree (AA), Certificate of Achievement (CA), or a Transfer Program. Students are expected to:

- Meet with an academic counselor to create an educational plan which outlines the courses they have completed and are required to complete to achieve their educational goal at Cuyamaca College.

- Use their educational plan, class schedule, college catalog and other college publications to help them complete their declared program of study.

- Enroll ONLY in courses required for their program to ensure meeting SAP requirements.

Satisfactory academic progress (SAP) is defined by the Department of Education as the normal length of time for a student to complete an educational objective that cannot exceed 150% of the length of the program. To receive financial aid, your educational objective must be an Associate’s Degree, Certificate, or Transfer to a four-year university.

When you apply for financial aid, we must review your entire academic record and determine whether you have made satisfactory academic progress. SAP standards apply to all students regardless of previous financial aid history. The following outlines our Satisfactory Academic Progress policy.

– Satisfactory Academic Progress – General

- Qualitative Measure - Grade Point Average (GPA), Students must maintain a semester and an overall GPA of 2.0 or higher. Also, students enrolled in an Associates degree or Transfer program must have an overall 2.0 GPA after two years.

- Quantitative Measure - Pace of Progression, Students must meet SAP standards listed below to make certain their overall completion rate is at least 79% of the units attempted per semester to ensure an acceptable Pace of Progression. Pace of Progression is calculated by dividing the number of units completed by the number of overall units attempted to calculate the student’s completion rate. (Example: a student has 65 units completed and 80 overall units attempted. By dividing 65 units completed by 80 units attempted the result is an 81% completion rate).

- Full-time students (12 or more units) must complete at least 9 units each semester

- Three-quarter-time students (9-11.15 units) must complete at least 7 units each semester

- Half-time students (6-8.5 units) must complete at least 5 units each semester

- Less than half-time students (0.5-5.5 units) must complete .5 units

3. Maximum Timeframe - Unit Limit, Since most Cuyamaca College Associate

degree programs and GE Transfer programs are approximately 60 units, students will be expected to complete their educational objective by the time they have completed 71 units or attempted 90 units, whichever occurs first (60 units times 150% equals 90 units attempted maximum). This includes changes in majors and all units completed at all other schools, and applies to students working towards completing an Associate’s Degree or Transferring. Students working towards completing a Certificate program will be expected to complete their educational objective by the time they have completed 36 units and/or attempted 45 units, whichever comes first.

NEED FUTHER HELP, WATCH THE FOLLOWING SAP VIDEO.

12

Students who have completed 71 units or attempted 90 units (for Associates Degree/Transfer objective) or 36 units completed or 45 attempted (for Certificate objective) will be required to submit an appeal for Maximum Timeframe to determine further eligibility for financial aid at Cuyamaca College. In evaluating the appeal, the Financial Aid office will determine if the student will be able to complete their program of study (major and educational objective) within 150% of the program length in order to be eligible for further financial aid (except the fee waiver and scholarships). Generally, this unit maximum is enough to provide financial aid for one educational objective rather than multiple objectives.

Once a student has completed their educational objective or is determined (through the appeal process) to not be able to complete their program of study within 150% of the program length, they will not be eligible to receive any more financial aid at Cuyamaca College (except for the fee waiver and scholarships).

– English as a Second Language (ESL)

Students may be funded to a maximum of 35 units of ESL. The maximum number of units to be funded will be determined by the student's CELSA placement score and/or Ed Plan. ESL courses that are degree applicable or transferable are excluded from the ESL unit limit and count as regular units. ESL courses taken in a descending order (for example, if you have already passed ESL 103 and take ESL 100 the next semester) or below the placement score (for example, if your CELSA score recommends entry at ESL 100 and you enroll in ESL 96) will count as regular units and may not be deducted. Exceptions may be made if documented by Cuyamaca personnel and approved by the Financial Aid department.

For more information on the CELSA test, go to Assessment Services Webpage or contact the Assessment Center at (619) 660-4426. To register for the CELSA go to WebAdvisor and under the “STUDENTS” menu look for the “Orientation/Assess/Advising” section.

– Remedial Coursework

Students may be funded to a maximum of 30 units of remedial courses if documented by assessment scores and/or an academic counselor. Remedial courses taken in descending order or below the placement score will count as regular units and may not be deducted. Exceptions may be made if documented by Cuyamaca personnel and approved by the Financial Aid department.

Review Policy – General

1. The following will be considered as units completed and attempted:

- “A” through “D” grades

- “CR” or “P” passing with credit

2. The following will be considered units attempted, but not completed (deficient units):

- “F” grade

- “W” (Withdrawal)

- “I” (Incomplete)

- “NC” or “NP” (No Credit or Not Passed)

- All repeated courses count toward the maximum unit timeframe and the minimum 2.0 GPA standard, including semesters for which Academic Renewal may have been applied by Admissions and Records.

Review Policy – Did Not Receive Aid the Previous Academic Year

If you did not receive financial aid during the previous academic year, we will review your entire academic record at Cuyamaca College, as well as coursework transferred in from other colleges. Satisfactory academic progress will be assessed if you have attempted 12 or more units. This includes coursework transferred into Cuyamaca College.

The overall number of units completed will be compared to the overall number of units attempted. If you are deficient by 12 or more units or your overall GPA is less than 2.0, you will be required to appeal for lack of progress/low GPA. New applicants who are not meeting SAP standards are not eligible for Financial Aid Warning consideration.

Review Policy – Received Aid the Previous Academic Year

Your GPA and number of units completed will be checked at the end of each semester and evaluated based on the SAP general standards above.

- Financial Aid Warning Status

- Students not on Financial Aid Warning status or Financial Aid Academic Probation, who are paid at ½-time enrollment or higher (6 or more units), and do not make SAP for the semester will be placed on Financial Aid Warning for the next semester.

- Students who are paid at less than ½-time status are not eligible to be placed on Warning status.

- Students placed on Warning status are eligible for financial aid for the Warning term and must make SAP for that term in order to maintain their financial aid eligibility.

- Students will be notified in writing that they have been placed on Warning status and they will not be required to submit a Financial Aid appeal for the Warning term. A student placed on Financial Aid Warning who does not make SAP again for the Warning term will be disqualified the following term and will be subject to the Financial Aid Appeal process.

- Financial Aid Disqualification Status

- All students who do not make SAP (excluding students who meet the Financial Aid Warning standards detailed above) will be disqualified from receiving financial aid.

- Students who choose not to go through the Financial Aid Appeal process or who do not make SAP while on Financial Aid Probation will be disqualified and will not regain eligibility for financial aid at Cuyamaca College until they meet the reinstatement conditions (see below).

- Financial Aid Probation Status

- Students who were disqualified for not meeting Financial Aid SAP standards have the option to submit an appeal through the Financial Aid Appeal process. Students who are approved through the Appeals process will be placed on Financial Aid Probation and are eligible for financial aid.

- Students on Financial Aid Probation must make SAP according to SAP general standards above and may also need to meet the conditions set by the Appeals Committee to maintain financial aid eligibility.

Students who are subject to disqualification going into summer will be required to submit a petition for reinstatement for the subsequent fall or spring term. If a student receives financial aid in the summer session, they will be held to the SAP criteria previously outlined in the General SAP standards.

Financial Aid Appeal Process

Students may appeal for reinstatement or continuation of financial aid by submitting a Financial Aid Petition form to the Financial Aid Office. The Financial Aid Petition must indicate:

- The extenuating circumstances surrounding why you did not complete the minimum number of units, maintain a 2.0 GPA, or exceeded the maximum unit timeframe.

- The steps you will take to improve your academic status or positive progress to complete your educational objective.

3. Documentation to support your extenuating circumstances.

Students will receive written notification of the appeal decision. If you must appeal because of lack of satisfactory progress, you are not eligible for retroactive awards if the appeal is approved.

Conditions for Reinstatement after Disqualification or Disapproved Appeal

Reinstatement is not an automatic process and is not guaranteed. Students may attempt to regain eligibility for financial aid after disqualification and/or denial of appeal for lack of progress by:

- Enrolling in a minimum of six (6) units and completing a semester of SAP according to the previously outlined General SAP standards

- Submitting a Financial Aid Petition form (check Financial Aid Reinstatement box in Section 1) and appropriate information/documentation as outlined on the petition form

- Complying with any other specific conditions that were set in the appeal decision made by the Appeals Committee

Having your appeal approved

13

(BACK TO TABLE OF CONTENTS)

If you receive federal financial aid and withdraw from all of your classes during the first 60% of a term, you may be required to repay a portion of the federal grants that you have received but not earned. Financial aid is said to be “earned” each day that you are enrolled in the semester.

If you stay in classes past the 60% of the term you may not owe anything back to the federal government. For the fall 2016 semester, students must be enrolled and attend classes until 10/28/2016 to be considered eligible for all the financial aid received. If all classes are dropped before 10/28/2016 you may be billed for a portion of the Pell Grant, FSEOG or Direct Loan received in the fall. For the spring 2017 semester, you must be enrolled and attend classes until 04/12/2017 to be eligible for all the financial aid received. If all classes are dropped before 04/12/2017 you may be billed for a portion of the Pell Grant, FSEOG or Direct Loan received in the spring.

Please Note: If you fail all classes in a term, you will have only earned 50% of the Pell, SEOG or Direct Loan received and may be billed for the amount not earned. This rule applies even if you were enrolled in classes for the whole term.

If required to repay funds to the federal government, you may be billed and will have 45 days to repay the funds in full. You may not be eligible for any further financial aid at any college in the United States until the funds have been repaid in full.

– Overpayments

You can be considered to have received an overpayment of federal funds if, for example

- Payments are made to you and you already have a Bachelor’s degree (or the equivalent from another country) – for Federal Grants only.

- Payments are made to you based on incorrect information on your financial aid or admissions application.

- Payments are made to you after you are no longer enrolled in the required number of units.

- Payments are made to you, but you drop all of your classes.

- Payments are made to you while you are in default on a student loan or you owe a refund on a federal grant.

- Payments are made to you when you receive financial aid from Cuyamaca College and from another institution.

If you have an overpayment or are repaying an overpayment, you will not be eligible for any federal aid at any school until the amount you owe is repaid.

14

(BACK TO TABLE OF CONTENTS)

- What it costs to attend, and what the policy is on refunds for students who drop out.

- How the school determines whether students are making satisfactory academic progress, and what happens if they are not.

- What financial help is available, including information on all federal, state, and school financial aid programs.

- About the deadlines for submitting applications for each of the financial aid programs available and what criteria is used to select financial aid recipients.

- How individual financial need is determined. This process includes how costs for tuition and fees, room and board, transportation, books and supplies, personal and miscellaneous expenses, etc., are considered in your budget.

- What resources are considered in the need calculation, (such as parental contribution, other financial aid, personal assets, etc.), and how much of your financial need, as determined by the school, is met.

- To explain the various programs in your student aid package. If you believe you have been treated unfairly, you may request reconsideration of the award.

- How much of your financial aid must be repaid, and what portion is grant aid. You have the right to know what the student loan interest rate is, the total amount that must be repaid, payback procedures, when repayment is to begin, and how long you have to repay.

- How to apply for additional aid if your financial circumstances change.

– As a financial aid recipient, it is your responsibility to:

- Review and consider all information about a school’s program before enrolling.

- Complete the financial aid application accurately and submit it on time to the appropriate processor. Errors delay the processing of your financial aid application. Intentional misrepresentation on an application for federal financial aid is a violation of law and a criminal offense subject to penalties.

- Respond promptly and return all requested additional documentation, verification, corrections, and/or new information to the appropriate agency.

- Read, understand, and keep copies of all forms and agreements that you sign.

- If you have a loan, notify the school and lender of changes in your name, permanent mailing address, marital status, or enrollment status.

- Perform, in a satisfactory manner, the work that is agreed upon in accepting a Federal Work-Study award.

- Know and comply with the deadlines for application or reapplication for aid, and with the school’s refund procedures.

- Report the receipt of all resources not considered in evaluating your eligibility.

- Maintain satisfactory academic progress according to the school’s policies and standards.

- If you have a loan, complete exit loan counseling before you leave school or drop below half-time enrollment

- Respect and abide by the Student Code of Conduct defined in the Cuyamaca College Catalog.

15

(BACK TO TABLE OF CONTENTS)

Drug Abuse Prevention Program

The Grossmont-Cuyamaca Community College District prohibits the unlawful possession, use, or distribution of illicit drugs or alcohol by students on district property or at any District sponsored or sanctioned activity.

Any student or employee in violation of this policy is subject to disciplinary action, up to and including expulsion from the District or termination of employment. The decision to take disciplinary action in any instance rests with the Governing Board after consideration of recommendations made by the site administrator and advisory panel.

action, up to and including expulsion from the District or termination of employment. The decision to take disciplinary action in any instance rests with the Governing Board after consideration of recommendations made by the site administrator and advisory panel.

The possession, use, or sale of alcoholic beverages by anyone on District property is a violation of the California Business and Professions Code 25608, as well as the Student Code of Conduct. The possession, use or sale of any illegal drug is a violation of state law and any person found in violation may be subject to arrest by federal, state, and local law enforcement authorities. Criminal prosecution is separate from any administrative discipline that may be imposed by the District.

The Grossmont-Cuyamaca Community College Governing Board has adopted policies regarding the possession and use of tobacco, alcoholic beverages, narcotics, and other substances. In addition, the Board, through its powers of governance, actively encourages and supports College and District Administrators in their planning and implementation of the following activities all of which are designed to discourage and/or prevent substance abuse among all officers, employees, students, and citizens within the District. In furtherance of these policies the Board provides:

- Individual Counseling - The Grossmont College and Cuyamaca College Counseling Centers are staffed with professional counselors trained in analyzing the personal problems of students and staff, as well as in assisting them in their educational and career planning.

- Referral to Community Resources - Many of the community service centers operating in San Diego County have been researched by District staff. A listing of substance abuse service agencies has been compiled and is available for distribution to students and staff. Agencies were selected based upon target clientele, services offered, fees charged, and proximity to the college campus.

- Availability of Substance Abuse Information - Information on substance abuse is available on campus as follows:

a) Films, literature, and speakers on drug abuse are held during College Hour and at

the Health and Wellness Center.

b) Addiction Hotline number 1-800-827-5596.

c) Posters about substance abuse are placed in selected locations and rotated

periodically.

d) Alcoholics Anonymous Central Office and the 12 steps number (619) 265-8762.

e) Federal Substance Abuse and Mental Health referral service number

1-800-662-4357.

f) Cuyamaca College Crisis Response Procedures

– Person in Crisis - Call Public Safety 644-7654 initial responders

– Switchboard Help - Public Safety Officer 644-7654

– Health and Wellness Center 660-4200

– Administrator on Duty 660-4000

– Associate Dean of Student Affairs 660-4295

– In any case where a weapon is involved, PUBLIC SAFETY will take the lead.

– Public Phones on Cuyamaca College Campus Dial #1 for Public Safety or 911

or use Blue Emergency Call Boxes at various locations on campus.

– WHEN YOU CALL PUBLIC SAFETY, DON’T HANG UP – STAY ON THE LINE AND

PROVIDE ALL INFORMATION REQUESTED.

4. Courses That Include Substance Abuse Issues – HED 120, Personal Health and Life

– HED 203, Substance Abuse and Public Health – BIO 115, Biology of Alcohol and

other Drugs

16

(BACK TO TABLE OF CONTENTS)

-

Cuyamaca College Financial Aid - https://www.cuyamaca.edu/services/finaid/default.aspx (619-660-4201)

-

California Student Aid Commission (Cal Grant, Chafee, Child Development Grant) - www.csac.ca.gov (888-224-7268)

-

Free Application for Federal Student Aid (FAFSA) - www.fafsa.ed.gov (800-433-3243)

-

Federal Student Aid (Grants, Loans) - www.studentaid.ed.gov (800-433-3243)

-

Cuyamaca College Scholarship Specialist - https://www.cuyamaca.edu/services/finaid/scholarships/default.aspx (619-660-4537)

-

Cuyamaca College EOPS - https://www.cuyamaca.edu/services/eops/default.aspx (619-660-4204)

-

Cuyamaca College CARE - https://www.cuyamaca.edu/services/eops/care.aspx (619-660-4204)

-

Cuyamaca College Career Center - https://www.cuyamaca.edu/services/career/default.aspx (619-660-4436)

-

Cuyamaca College Assessment - https://www.cuyamaca.edu/services/assessment/default.aspx (619-660-4426)

-

Office of Inspector General (Dept. of Education) - www2.ed.gov/about/offices/list/oig/index.html (800-641-8799)

NOTE: Care has been taken to ensure the accuracy of information contained in this publication. The information, is however, subject to change.

17

(BACK TO TABLE OF CONTENTS)